See This Report on Tidepoint Construction Group

Wiki Article

The Tidepoint Construction Group Diaries

There are plenty of points that could gain from a fresh coat, from closets to stairwells to an accent wallresearch which colors function best where. Light colors make tiny rooms look larger, so brighten up shower rooms and smaller locations with those. Be certain to talk to a specialist on which kind of paint to use before acquiring, as some are less vulnerable to mold and mildew and mildew if made use of in a washroom. https://tidepointconstructiongroup.godaddysites.com/.

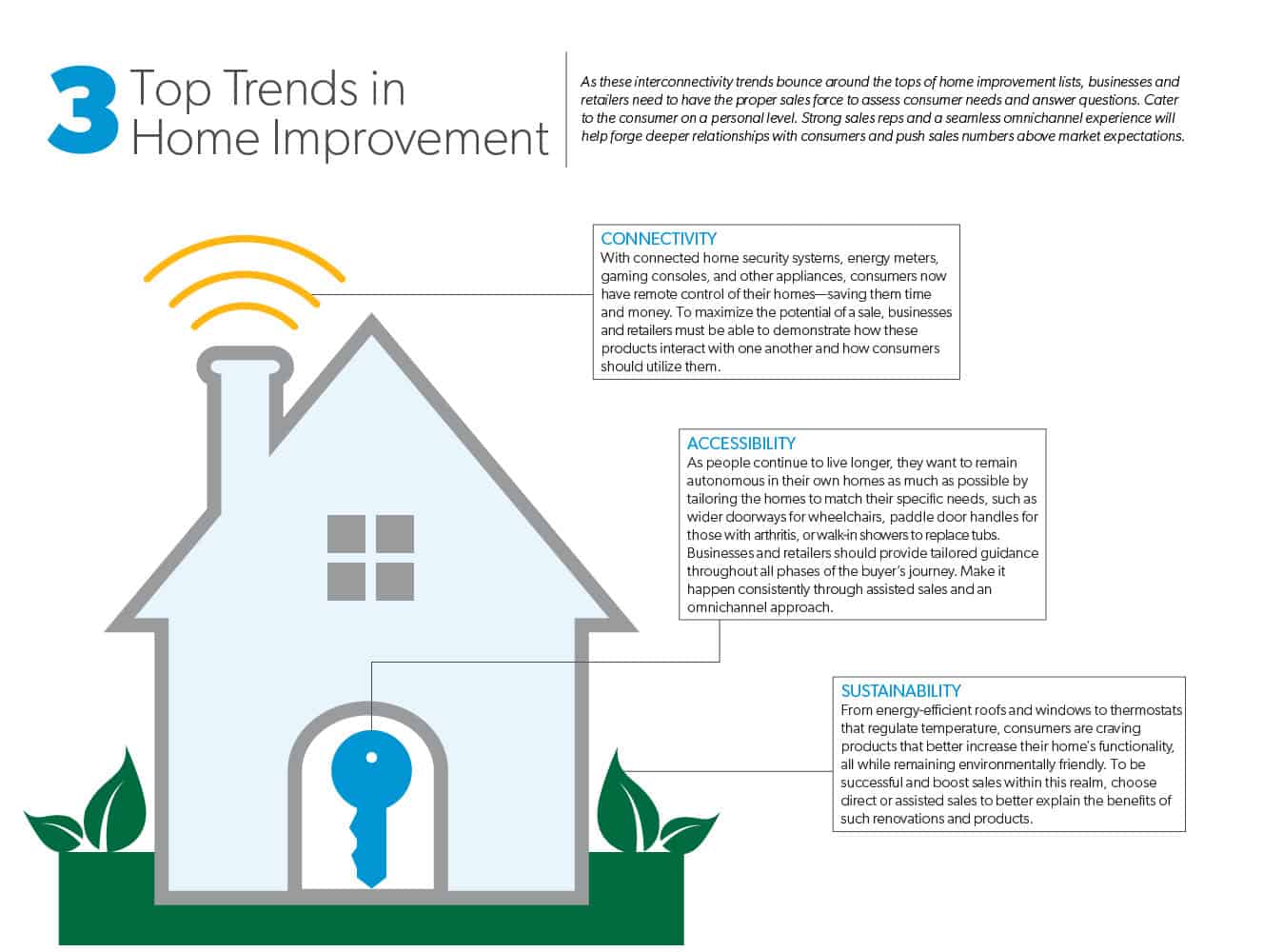

Buy ADA-compliant devices like bathroom paper owners and towel bars that not only include to the appearance of your home however the safety and security of it as well. In addition, points like motion-activated outdoor lights are not only energy-efficient however can prevent burglars from entering your home. While numerous think renovation is just advantageous from an aesthetic viewpoint, there are a handful of other advantages that occur from maintenance, remodels and also constant fixings exactly why there are a lot of programs dedicated to spending and loaning cash towards it.

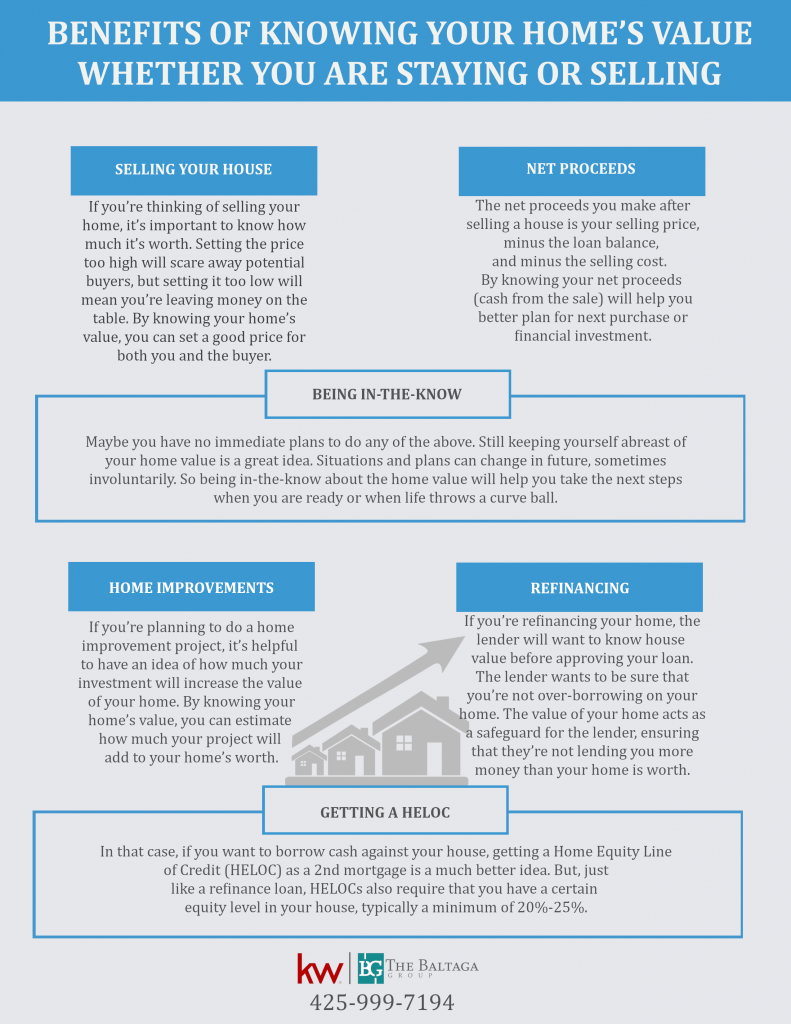

Also though you might be forking up cash money at initially, buying high-grade products upfront will certainly enable for less costly and undesirable fixings in the process. Comparable to the above point, buying upgrades can increase the resale worth of your residence must you prepare to sell in the future.

Restorations aid to avoid these types of problems before they occur Website and also can also make living problems better for your furry good friends . Total comfort and livability are critical to your mental wellness as well. A fresh coat of paint or a recently crafted residence gym can foster a clean house and also mind.

Getting My Tidepoint Construction Group To Work

Are residence repair work or upgrades tax obligation insurance deductible? If so, what residence improvements are tax insurance deductible? These are essential questions to ask on your own if you've dealt with restorations in 2022, or if you're planning to this year. Let's dive in a little deeper. Before crossing out house renovations on your tax obligations, it's important to know the difference in between reductions and also credit scores.

According to the internal revenue service, tax obligation reductions minimize your overall gross income, while tax credit scores decrease the amount of money you must pay. Simply put, home improvement tax obligation credits are a dollar-for-dollar decrease of tax obligations and also deductions are decreased by just how much money you make per year. The majority of residence renovations drop under the deduction umbrella, yet there are a few exemptions.

It ultimately boils down to what sort of remodel you're completing and also whether it's identified as a repair or a renovation. is any type of modification that recovers a home to its initial state and/or value, according to the internal revenue service. Home repair services are not tax insurance deductible, except when it comes to house workplaces as well as rental residential properties that you own even more to come on that particular later in this overview.

, a brand-new septic system or built-in home appliances. Home enhancements can be tax obligation deductions, however some are only insurance deductible in the year the home is offered.

How Tidepoint Construction Group can Save You Time, Stress, and Money.

If you're unsure whether a repair or renovation is tax obligation deductible, get in touch with a local tax obligation accounting professional who can answer your inquiries regarding filing. Please note residence renovation car loans aren't tax obligation insurance deductible considering that you can not subtract rate of interest from them.

The solar debt will continue to be till 2019, and after that it will certainly be minimized each year via 2021." Nevertheless, putting solar power systems on new or present residences can still lead to a 30% credit scores of the total price of setup. This credit report is not limited to your main house as well as is also offered for freshly constructed residences.

Tax Obligation Reduction Same Year Tax-deductible home improvements related to medical care are often difficult to come by. You can consist of expenses for medical equipment installed in your home if its main objective is to give treatment for you, your partner or a dependent. https://tidepointc0n.mystrikingly.com/blog/tidepoint-construction-group.

Repair services made directly to your workplace Improvements made directly to your workplace area Fixes made to other parts of the residence (partly insurance deductible) Some enhancements made to other components of the residence (partly deductible) Repairs that straight influence your service space can be deducted completely (e. g., fixing a broken home window in your workplace).

Some Of Tidepoint Construction Group

If your workplace inhabits 20% of your house, 20% of the renovation price is tax-deductible. General contractors Hilton Head.

8% Rating major resale worth as well as some wonderful R&R time by adding a timber deck to your yard. Simply make certain to include railings, pressure-treat the wood, as well as seal it to secure it from the aspects.

If it's also fashionable or too tailor-made, it will likely estrange some customers when you're all set to market.

Report this wiki page